منع رفض شيكاتك من الرفض: أخطاء الطباعة MICR

في عصر تهيمن فيه المعاملات الرقمية، لا يزال الشيك الورقي المتواضع يحتفظ بمكانته في المعاملات المالية المختلفة. ونظراً لاستمرار ارتفاع معدلات الاحتيال في الشيكات، فمن المهم طباعة الشيكات على بياض لتجنب الاحتيال. ومع ذلك، فإن كفاءة طباعة الشيكات تعتمد بشكل كبير على تقنية التعرف على أحرف الحبر المغناطيسي (MICR)، وهو نظام يسمح للآلات بقراءة المعلومات الأساسية على الشيكات. على الرغم من أهميتها، إلا أن التطبيق غير السليم لتقنية التعرف على أحرف الحبر المغناطيسي (MICR) لا يزال يمثل مشكلة كبيرة.

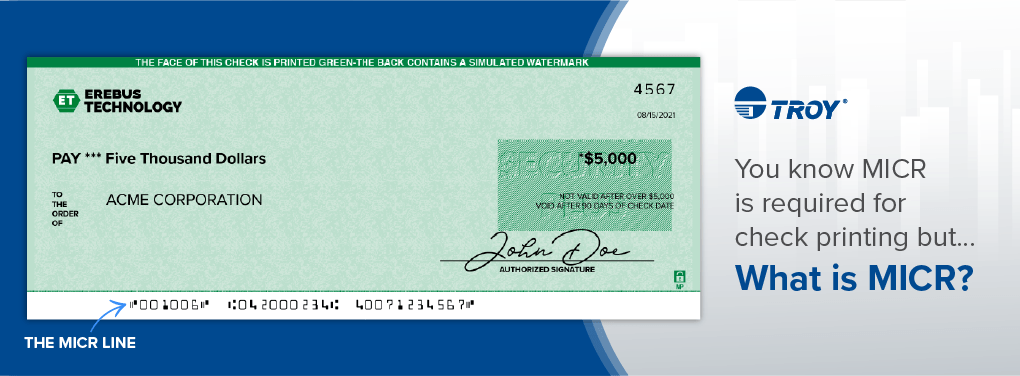

ما هو الـ MICR؟

MICR هي تقنية تُستخدم لتسهيل معالجة الشيكات. وهي تتضمن طباعة الأحرف - مثل رقم التوجيه، ورقم الحساب، ورقم الشيك - باستخدام نوع خاص من الحبر يحتوي على أكسيد الحديد. تُطبع هذه الأحرف بخط معين يُعرف باسم E-13B أو CMC-7، والذي يمكن قراءته بسهولة بواسطة الماسحات الضوئية للشيكات.

لا يسمح خط MICR للماسحات الضوئية بقراءة الشيك بسهولة، ولكن هذه الخطوط المطبوعة بحبر أو حبر MICR هي شرط من قبل الجمعية المصرفية الأمريكية. وهذا يطرح السؤال - ماذا يحدث إذا لم تقم بالطباعة باستخدام خطوط MICR بحبر أو حبر MICR المناسب؟

حالات الرفض المصرفي بسبب رداءة MICR

حتى الانحرافات الطفيفة في طباعة MICR يمكن أن تؤدي إلى رفض الشيك أثناء مرحلة المعالجة، وهو ما يمكن أن يؤدي إلى تراكم المشاكل. يمكن أن يكون للشيكات المرفوضة بسبب التنفيذ غير الصحيح لطباعة الشيكات الآلية غير الصحيحة آثار مالية كبيرة على الشركات والأفراد. فكل شيك مرفوض لا يمثل فقط تأخيراً في الدفع، بل أيضاً احتمال فرض رسوم وغرامات إضافية.

قد تتقاضى البنوك من عملاء الشركات مبلغاً يتراوح بين 0.50 دولار إلى 6.00 دولارات عن كل عنصر يتطلب التصحيح، أو عن معالجة مستندات MICR ذات الجودة الرديئة. يمكن أن يؤدي الوقت والموارد المطلوبة لتصحيح الشيكات المرفوضة إلى زيادة الضغط على المؤسسات المالية والشركات.

إذا كنت تقوم بطباعة معلومات حسابك على مخزون شيكات على بياض، وهو ما يجب عليك فعله لتقليل مخاطر الاحتيال، يجب أن تتأكد تماماً من طباعتك بشكل صحيح، وهو أمر يسهل قوله وفعله. إذاً، ما الخطأ الذي يمكن أن يحدث؟

المشكلات الشائعة في تنفيذ MICR

على الرغم من أهميته، إلا أن هناك العديد من العوامل التي يمكن أن تساهم في التنفيذ غير السليم للشيكات ذات الرقاقة الممغنطة الآلية MICR، مما يؤدي إلى رفض الشيكات. وتشمل بعض المشاكل الأكثر شيوعاً ما يلي:

جودة الحبر أو الحبر:

يمكن أن يؤدي استخدام جودة منخفضة للحبر أو الحبر MICR أو تقنيات الطباعة غير السليمة إلى خطوط MICR باهتة أو غير مقروءة، مما يجعل من الصعب على الآلات قراءة المعلومات بدقة.

أخطاء المحاذاة:

يمكن أن يحدث اختلال في محاذاة أحرف MICR أثناء عملية الطباعة، مما يتسبب في وضع الأحرف بشكل غير صحيح على خط MICR. يمكن أن يؤدي ذلك إلى قراءات خاطئة أو فشل كامل في التعرف على أجهزة قراءة MICR.

اختلافات الخط والحجم:

الانحرافات عن المعيار E-13B أو الخطوط CMC-7 القياسيةبالإضافة إلى الاختلافات في حجم الأحرف، يمكن أن تعيق قراءة أحرف MICR، مما يؤدي إلى رفضها أثناء المعالجة.

كيف يمكنك تجنب مشاكل الطباعة مع TROY:

لحسن الحظ، تمتلك TROY مجموعة طابعات MICR الأكثر تطورًا في السوق، مما يتيح لك طباعة الشيكات بدقة وكفاءة. تتيح لنا شراكة TROY الممتدة على مدار 30 عامًا مع HP تعزيز طابعة HP القياسية بميزات الأمان اللازمة لطباعة الشيكات بأمان ودقة وجودة عالية، مما يضمن لك راحة البال بأن مدفوعاتك لن تواجه رفضًا من البنك.

استشعار الحبر: ميزة استشعار الحبر هي ميزة تسمح للطابعة بالتعرف على وجود حبر أو حبر MICR، لذا فأنت تستخدم حبر أو حبر MICR دائماً لطباعة شيك.

التموضع الدقيق التقنية: تسمح تقنية TROY ExPT، أو تقنية تحديد الموضع الدقيق، بتحديد موضع خط MICR أو صورة الشيك بدقة، بحيث لا توجد أي أخطاء في المحاذاة.

خطوط MICR: مع إضافة خطوطنا إلى طابعتك الحالية من HP، سيكون لديك القدرة على طباعة خطوط CMC7 وخطوط E13B، والعديد من الخطوط الإضافية من جهاز واحد.

حبر MICR Toner Secure: يتميز حبرنا MICR Toner Secure الحائز على براءة اختراع بالالتصاق العالي اللازم لقابلية القراءة، ويحتوي أيضًا على صبغة حمراء تنشط في أي وقت يتم فيه محاولة تغيير كيميائي على الشيك. كن مطمئنًا أن شيكاتك محمية من الاحتيال وستتم قراءتها دائمًا بدقة بواسطة الماسحات الضوئية للشيكات.

التنفيذ والاختبار بشكل صحيح مع TROY:

على الرغم من أن تقنية TROY كافية لضمان قراءة شيكاتك بدقة من قبل البنك، إلا أنه يجب إجراء الاختبار لضمان قوة إشارات MICR وقابلية القراءة قبل البدء في طباعة دفعة من الشيكات. يتيح لك برنامج طباعة الشيكات المستند إلى السحابةAssurePay Check من TROY إرسال شيكات اختبارية إلى البنك قبل البدء في الطباعة، وهو ما نوصي به.

لا يمكن المبالغة في أهمية التنفيذ السليم لطباعة الشيكات الآلية MICR. يمكن أن يساعد الاستثمار في معدات الطباعة والحبر والورق عالي الجودة، بالإضافة إلى الالتزام بمعايير الصناعة لطباعة MICR، في التخفيف من مخاطر رفض الشيكات وتبسيط عملية الدفع لجميع الأطراف المعنية.

تعرف على المزيد حول MICR هنا.

منشورات ذات صلة

دليلك لاختيار أفضل برامج طباعة الشيكات

في عالم الأعمال سريع الإيقاع، الكفاءة هي المفتاح. أحد المجالات التي يمكن أن يكون للكفاءة فيها تأثير كبير هو مجال طباعة الشيكات وبرامج طباعة الشيكات. كما..

5 فوائد للطباعة باستخدام الأحبار القابلة للمعالجة بالأشعة فوق البنفسجية

عندما يتعلق الأمر بصناعة الطباعة، تصبح السرعة والموثوقية في غاية الأهمية. يريد العملاء أن تتم طباعتهم بسرعة ودون التعرض لخطر التلف أو التلطيخ. العمل..

5 مزايا ماكينة إدخال المجلدات 5

لنبدأ هذه المدونة بقصة بسيطة عن مارك، مدير قسم الحسابات الدائنة المسؤول عن المسؤوليات المالية المتنامية للشركة. مع توسع الشركة، لذا

اترك رد